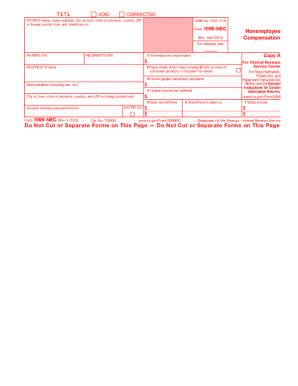

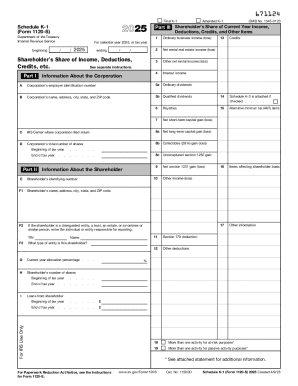

IRS Instruction 843 2024-2026 free printable template

Show details

What s New Redesigned. We have redesigned Form 843 and these instructions. Do not use Form 843 to request an abatement of income estate or gift tax. Checkboxes at the top of Form 843. Check the box at the top of your Form 843 that provides your reason for filing the form. Those reasons are listed below. Someone who prepares your Form 843 but does not charge you should not sign it. Your Form 843 may deal with situations that have special qualifications or special rules. Also do not use Form...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 843

Edit your form 843 irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 843 instructions 2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs instructions form 843 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 843 instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 843 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs form penalty abatement

How to fill out IRS Instruction 843

01

Obtain a copy of IRS Form 843 from the IRS website or your local IRS office.

02

Read through the instructions provided on the form carefully to understand the requirements.

03

Fill out your personal information in the designated fields, including your name, address, and Social Security number (or EIN if applicable).

04

Indicate the reason for your request in Part I of the form.

05

Provide any relevant details regarding your claim or request in Part II, ensuring all required documentation is attached.

06

Check the box indicating whether you are requesting a refund, abatement, or other treatment.

07

Sign and date the form in the appropriate section.

08

Send the completed form to the appropriate IRS office as specified in the instructions.

Who needs IRS Instruction 843?

01

Individuals or businesses seeking a refund of overpaid taxes or penalties.

02

Taxpayers looking to request an abatement of certain penalties.

03

Anyone who believes they were incorrectly charged taxes and wishes to contest it.

04

Individuals who want to address issues related to tax credits or adjustments.

Fill

irs form 843 fillable

: Try Risk Free

People Also Ask about irs form 843 instructions pdf

What is form 843 claim for refund and request for abatement?

Form 843 is used to claim a refund of certain assessed taxes or to request abatement of interest or penalties applied in error by the IRS. The form must be filed within two years from the date when taxes were paid or three years from the date when the return was filed, whichever is later.

What is the best explanation for form 843?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Can you file form 843 online?

Note that Form 843 cannot be e-filed. Check the instructions for Form 843 for where to mail.

What is the 843 form used for?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What is a good reasonable cause for penalty abatement?

Failure to File or Pay Penalties Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

What is reasonable cause for IRS form 843?

Reasonable cause: A death in the family, inability to obtain records, natural disasters, and other related instances. It's important to note that the IRS will not consider a lack of funds a reasonable cause.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get irs form 843 pdf?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the form 843 example in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit form 843 pdf straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 843 form instructions.

How can I fill out form 843 mailing address on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your irs gov form 843. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is IRS Instruction 843?

IRS Instruction 843 is a form used to apply for a refund or abatement of specific taxes and to request an administrative adjustment to certain tax liabilities.

Who is required to file IRS Instruction 843?

Individuals or entities that believe they are entitled to a refund or abatement of taxes previously paid are required to file IRS Instruction 843.

How to fill out IRS Instruction 843?

To fill out IRS Instruction 843, taxpayers should complete the form by providing their identification information, the type of tax involved, the relevant tax period, and a detailed explanation of the reason for the refund or abatement request.

What is the purpose of IRS Instruction 843?

The purpose of IRS Instruction 843 is to provide taxpayers a formal mechanism to request a refund or reduction of taxes due to overpayment, incorrect assessments, or other valid reasons.

What information must be reported on IRS Instruction 843?

The information that must be reported on IRS Instruction 843 includes taxpayer identification details, the type of tax, the tax period in question, the amount requested for refund or abatement, and a clear explanation of the grounds for the request.

Fill out your IRS Instruction 843 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Form 843 is not the form you're looking for?Search for another form here.

Keywords relevant to irs abatement form 843

Related to form 843 for business

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.